Portal

Type: Regulation

Responsible Agency: Bank of the Lao PDR

Issuing Date: 1999-08-30

Click here to see the measures contained in this document

Contents

REGULATION On Depositor Protection Fund

Article 2: Definition of the Depositors Protection Fund

Section 2: Establishment, Right and Responsibility of the depositors Protection Fund

Article 3: The Establishment of the Depositors Protection Fund

Article 4: Rights and Responsibility of the Fund

Article 5: Management of the Fund

Article 6: Members of the fund

Article 7: Rights and Obligation of Members of the Fund

Article 8: Dismissing from Membership of the Fund

Section 4: Contribution of the Premium

Article 9: Premium Contribution to the Fund

Article 10: Payment of Contribution

Section 5 Rights of Protection

Article 12: In-Eligible Deposits

Article 13: Payment of Compensation

Article 14: Compensation Payment Conditions

Article 15: Declaration of Incapable Obligation of Commercial Bank

Section 6 Capital, Revenue-Expenditure and Accumulated Fund

Article 16: Capital of the Fund

Article 17: Revenue and ExpenditureArticle18: Accumulate Fund

Section 7: Commercial Bank Audit and Account of the Fund

Article 19: Commercial Bank Audit

Article 20: Account of the FundArticle 21: Confidentiality

Section 8: Measures for Those Who Violate

Article 22: Confidentiality Disclosed

Article 23: Premium contribution Violated

Lao People’s Democratic Republic

Peace Independence Democracy Unity Prosperity

The Bank of the Lao PDR No.:283./BOL

Vientiane, August 30, 1999

On Depositor Protection Fund

- Pursuant to the Law of Bank of Lao People’s Democratic Republic, No.: 05/95/NA date October 14, 1995.

- Pursuant to the Presidential Decree on Commercial Banks, No.: 01/PDR dated March 11, 1997.

- Pursuant to Business Law No.: 03/94/NA, dated July 18, 1994.

- Based on the unanimous decision of the Board of Governors of Bank of the Lao People’s Democratic Republic.

The Governor of the Bank of the Lao PDR regulates as follows:

General Provisions

This regulation shall determine the organizations and operation of Depositors of those commercial bank in the Lao PDR in case of failure and to create public confidence and insuring deposits made with the commercial banks operation in the Lao PDR.

Article 2: Definition of the Depositors Protection Fund

The Depositors Protection Fund is an entity and entitled to act on behalf of the commercial bank to insure deposits through compensation payment shall be at the amount determined by administrative of the Fund in the event of the failure or similar case of the member banks.

Establishment, Right and Responsibility of the depositors Protection Fund

Article 3: The Establishment of the Depositors Protection Fund

The Depositors Protection Fund, hereinafter referred to as the “Fund”, its abbreviation is “DPF”. The Fund shall be licensed by the Bank of the Lao PDR and Registered as legal enterprise under the Law on Business, No. 03/94/NA, dated July 18, 1994. It shall independently operate in accordance with the Law of the Lao PDR. The Fund shall replace the Rehabilitation Capital designated in Article 15 of the presidential Decree No.

01/PDR, dated March 11, 1997. All activities and management of the Fund shall be supervised by supervision and Examination Department of the Bank of the Lao PDR in similar fashion to its supervision and examination of the activities of commercial banks.

Article 4: Rights and Responsibility of the Fund

- The Fund shall have the rights as follows:

- request the member banks to provide all documents and information concerning the sustainability of the Banks such as ability to repay deposits to the customers when due,

- request the documents so as may be the evidences before compensation payment in case any member bank have been declared under Article 15 of this regulation,

- determine all compensation payment conditions such closed bank shall post those condition at the bank to make it known to the public,

- investing the assets of the Fund in a sound and prudential manner, and particularly in securities issued by the Government of the Lao PDR, the bank of the Lao PDR, and the government of developed countries,

- Borrow money at the proposal of the Board of Director and shall be approved by the Minister of Finance by any means, including the issuance of bonds, debenture or any other evidence of indebtedness. The interest rates shall not exceed the interest rates of the government bills and bonds. The purpose of the borrowing is to compensate to depositions in the event of failure of a commercial bank when the funds have insufficient.

- The responsibilities of the Fund are as follows:

- To collect contributions to the Fund from member banks,

- To insure eligible deposits in both local and foreign currency made with the commercial bank when it is failure under declaration of the Bank of the Lao PDR,

- To repay in whole or in part eligible deposits made with a member commercial bank when it is failure under declaration of the Bank of the Lao PDR,

- To conduct diligent monitoring and examination of member Banks, and undertake prompt, decisive and prudent interventions.

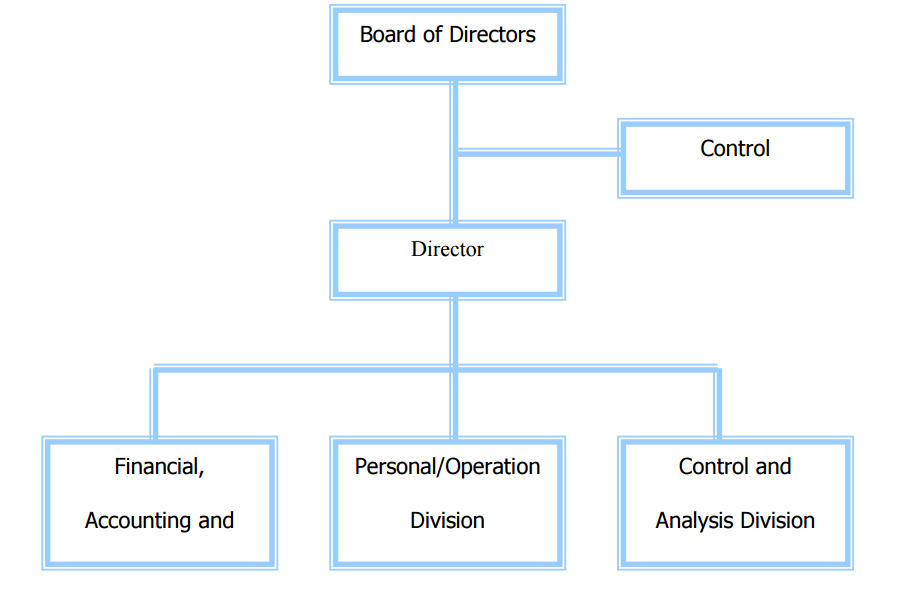

Article 5: Management of the Fund

The management structure of the Fund shall consist of the Board of Directors, including 5 to 7 members, the managing Directors, and employees as are necessary to enable the Fund to carry out its functions. The Board shall have a term of office of 3 years.

The rights and responsibility of the Board of Directors and managing Directors of the Fund shall be set out in the Charter of the Fund.

Article 6: Members of the fund

All commercial bank have been given a license to operate the banking business in the Lao PDR shall be a member of the fund.

Article 7: Rights and Obligation of Members of the Fund

The members of the fund shall have the rights and obligations as follow:

- pay the premium to the fund at the rate stipulate in the Article 9 of this regulation,

- co-ordinate with the accounting inspector or the person who was appointed to audit an accounting manner,

- provide all necessary documents and information to the fund, in particular document on depositing,

- implement strictly all regulations and policies outlined by the Bank of the Lao PDR,

- the member bank shall post the certificate of membership of the Fund and to announce to public the eligible deposits as delegate in the Article 11 of this regulation,

- propose an assistance from the Fund in case of insolvency.

Article 8: Dismissing from Membership of the Fund

Members of the fund shall be dismissing from membership of the fund in the following circumstance:

- violate all Article or obligation delegated in the Article 7 of this regulation,

- any member bank have been dismissed from membership of the fund shall pay the premium of the current year. The premium have been paid to the Fund is not refundable,

- such commercial bank shall inform to the customers on its dismissing, and the fund shall inform to the public as well,

- deposits accepted by commercial bank before dismissing from membership of the Fund shall be protected by the Fund, nor may the Fund protected such deposit after dismissing from membership of the Fund.

Contribution of the Premium

Article 9: Premium Contribution to the Fund

Member of the Fund shall contribute the premium to the Fund by way of an annual contribution at the rate of 0.1 percent of averaged deposits of each currency based on the last closing business year, and the premium shall not less than Kip 10 million. In case of necessity, The Fund may request and extraordinary contributions under the agreement of the Board of Directors of the Fund.

Article 10: Payment of Contribution

- Member of the Fund shall pay their contribution in two times. First time installment on, the second week of January at the rate of 0.1 percent of averaged deposit from January trough June. The second time installment shall be made in the second week of July at the rate of 0.1 percent of averaged deposits of the last closing business year after deduction from first time installment.

- Extraordinary contributions payment shall comply with the rate and timeline determined by the Board of Directors,

- All contributions mentions above shall be paid at the head office of the Fund, in the currency in which the eligible deposits are denominated and in pro rata of the total eligible deposits,

- Contributions to the Fund shall be computed as an annual expense of the banks.

Rights of Protection

Deposits eligible for protection by the Fund shall consist of all moneys deposited with a commercial bank in the Lao PDR, in either local or foreign currencies, and for which the commercial bank has an outstanding commitment to repay the same with or without interest. Eligible deposits are included demand deposits, saving deposits and terms deposits.

Article 12: In-Eligible Deposits

Deposits In-eligible for protection by the Fund shall consist of administrators’ deposits, deposit for loan guarantee, inter bank or other financial institution deposits, government deposits, central bank deposits and other deposits are not mentioned in the Article 11 of this regulation.

Article 13: Payment of Compensation

- Any commercial bank have been declared under Article 15 of this regulation, depositors with such commercial bank is entitle to receive the compensation in the currency and in which the eligible deposits are denominated and in pro rata of the total eligible deposits. Such compensation payment subject to a maximum amount of kip 15 million per person, including principal and interest. Compensation payment to depositors mush be made within 6 months after the date of declaration. However, in exceptional and reasonable cases, The Fund may extend this period of one and a half years,

- A depositor shall be entitled to receive interest at the rate agreed with the commercial bank calculated to the date on which the commercial bank deemed incapable of meeting its obligations pursuant to Article 15 of this regulation,

- Any amount due by the depositor to the commercial bank shall be deducted from the compensation payment to be made by the Fund to the depositors,

- The deposits recorded on the recorded of the commercial bank shall be final and conclusive as between the commercial bank and the depositors,

- The Payment compensation shall not meet unless the depositors fully completed all, compensation payment conditions,

- The Fund is authorized to arrange for compensation to be paid through closed bank or such other arrangements as the Fund may decided,

- If the depositor is prevented from presenting a claim for compensation during the period specified in Clause 1 of this Article, because of illness or other reasonable cause, the Fund may effect compensation after expiration of the said period, but within three years of the start of compensation payments,

- The remaining amount of deposits shall be implement pursuant to Regulation No.06/BOL, dated January 15, 1996 on the resolution of the closed bank.

Article 14: Compensation Payment Conditions

- Shall be a customer of the closed bank,

- Shall have necessary and completely document such as pas book so as may be finalized and conclusive as the commercial bank recorded,

- Shall fill in application form established by the Fund,

- Such written application shall submit to the Fund within one month after declaration day under Article 15 of this regulation,

- If the depositor is prevented from submit ion of the form because of any reasonable causes, he/she may transfer to another person to perform instead.

Article 15: Declaration of Incapable Obligation of Commercial Bank

- The bank of the Lao PDR shall declare a commercial bank to be incapable of meeting of its obligation in the following circumstances:

- If the commercial bank is unable to meet its due obligations with respect to deposits within 48 hours of any claim made on such deposits,

- If the bank of the Lao PDR determines that the regulatory capital (as defined in the Regulation on Capital Adequacy) of the commercial bank is or is about to become substantially deficient.

- If the bank of the Lao PDR appoints a Liquidation Committee to liquidate the problem bank,

- Any commercial bank have been declared as specified in Clause 1 of this Article shall be ordered to suspend all or some part of business activities pursuant to the consideration of the Bank of the Lao PDR and such commercial bank shall post a notice of the declaration in each branches of the commercial bank so as to be openly displayed to the public on the next working day after the day of declaration,

- Within 3 months after the bank of the Lao PDR issued such declaration, the Fund shall announce through the local media the details of compensation plan, including commencement date, the duration and place where compensation payments will be made.

Capital, Revenue-Expenditure and Accumulated Fund

Article 16: Capital of the Fund

The capital of the Fund comprises of the registered capital provided by the government and other reserve funds.

Article 17: Revenue and Expenditure

Revenue of the Fund is as follows:

- Premium,

- Interest earning from investments.

Expenditure of the Fund is as follow:

- Compensation payment,

- Administrative and operations,

- Amortization and depreciation.

Accumulated Fund is the difference between the revenue and expenditure of the Fund for the final year. Such accumulated fund shall divided as follow:

- Reserve fund,

- Other fund as the Board of Directors deems appropriated.

In case the expenditure is more than revenue, the Fund may use its reserve fund under the agreement of the Board of Directors.

Commercial Bank Audit and Account of the Fund

Article 19: Commercial Bank Audit

The Fund and a person appointed shall have the rights to audit

- The financial record and annual financial statement, and

- To request the Administrators, officer internal auditors, and other to prepare all data, information and explanation concerning deposits of the commercial banks as required.

Article 20: Account of the Fund

- The financial record and the annual financial statement (including balance sheet, income statement , and accumulated fund) shall be audited by suitable qualified independent auditors,

- No later than 21 days before the date of each annual meeting of the fund, the fund shall sent to the Supervision and Examination Department of the Bank of the Lao PDR:

- a comparative annual financial statement (including balance sheet, income statement, statement of change in shareholders’ equity) relating to both the financial year immediately preceding (the current year) and the previous financial year; and

- the report of the external auditors of the Fund.

- The Fund shall prepares and maintain records containing:

- The charter and internal regulations of the Fund as well as amendment thereto,

- corporate accounting record,

- minutes of meeting and resolutions of the Board of Directors and any committee thereof, and

- any other records necessary to adequately and accurately reports the business activities of the Fund.

Members of the Board of Directors, the Administrator and the staff of the Fund shall observe total confidentiality of a commercial bank and their customers.

Measures for Those Who Violate

Article 22: Confidentiality Disclosed

Any person mentioned in the Article 21 of this regulation is disclosed confidentiality of the Fund shall be put in to legal proceedings depending on case of graveness or in graveness.

Article 23: Premium contribution Violated

Any member bank of the Fund did not contribute the premium at the timeline, such bank shall be forced as follows:

- Warning and talking records,

- Penalties 0.05 percent per day of amount unpaid,

- In case a commercial bank did not comply with two clauses above, such bank shall be dismissed from membership of the Fund and shall be declared under Article 15 of this regulation

Final Provision

The Supervision and Examination Department of the Bank of the Lao PDR, Commercial Banks, The Fund and other organizations concerned shall strictly implement this regulation.

This regulation shall become effective on signature.

The Governor of the bank of the Lao PDR

Stamped and signed

Soukhanh Mahalaht

Management Structure of the Fund

Download English:Regulation on Depositor Protection Fund No. 283/BoL, dated 30 August 1999

Download Lao:Regulation on Depositor Protection Fund No. 283/BoL, dated 30 August 1999

List Measures Related to Legal Documents

| Name | Description | Status |

|---|---|---|

| Requirement for annual fee | Members of the Fund must pay an annual premium at the rate of 0.1 percent of averaged deposits of each currency | Active |

| Requirement to be member of fund | All licensed banks must be members of statutory fund. | Active |

| Compensation Payments | Payment of Compensation to depositors of commercial banks where the banks have been declared to be incapable of meeting their obligaitons, must be made within 6 months after the date of declaration if the prescribed payment condtions are met. | Active |

| Establishment of the Depositors Protection Fund | The Depositors Protection Fund shall be licensed by the Bank of the Lao PDR and Registered as legal enterprise | Active |

| Requirement to audit fund | The financial record and the annual financial statement (including balance sheet, income statement , and accumulated fund) shall be audited by suitable qualified independent auditors | Active |

| Requirement to become member of the fund | All commercial banks given a license to operate banking business in the Lao PDR shall be a member of the fund | Active |

| Requirement to declare a commercial bank incapable of meeting obligations | The bank of the Lao PDR shall declare a commercial bank to be incapable of meeting its obligation if the prescribed conditions are met, which include if the regulatory capital is or is about to become substantially deficient. | Active |